Irs Schedule Se 2024 Schedule – Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . The IRS announced the tax brackets for the tax year 2024 in November. The agency said in a press release that the top tax rate remains 37% for individual single taxpayers with incomes greater than .

Irs Schedule Se 2024 Schedule

Source : www.irs.govWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

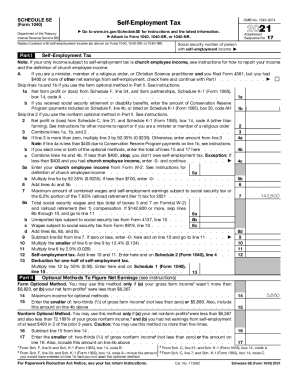

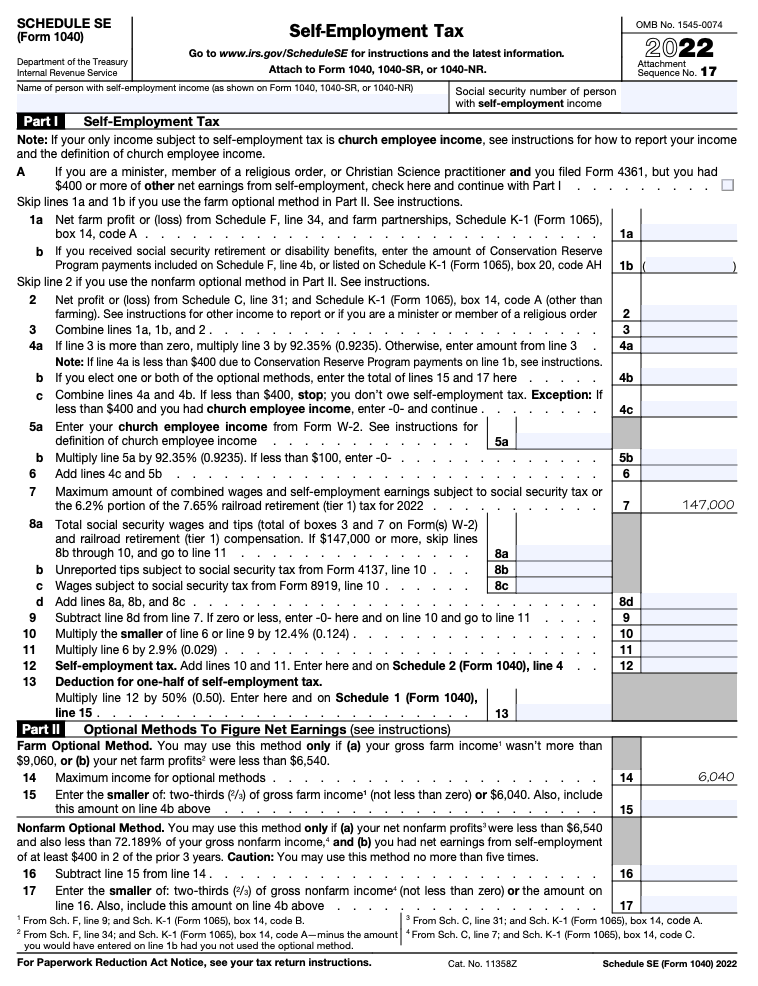

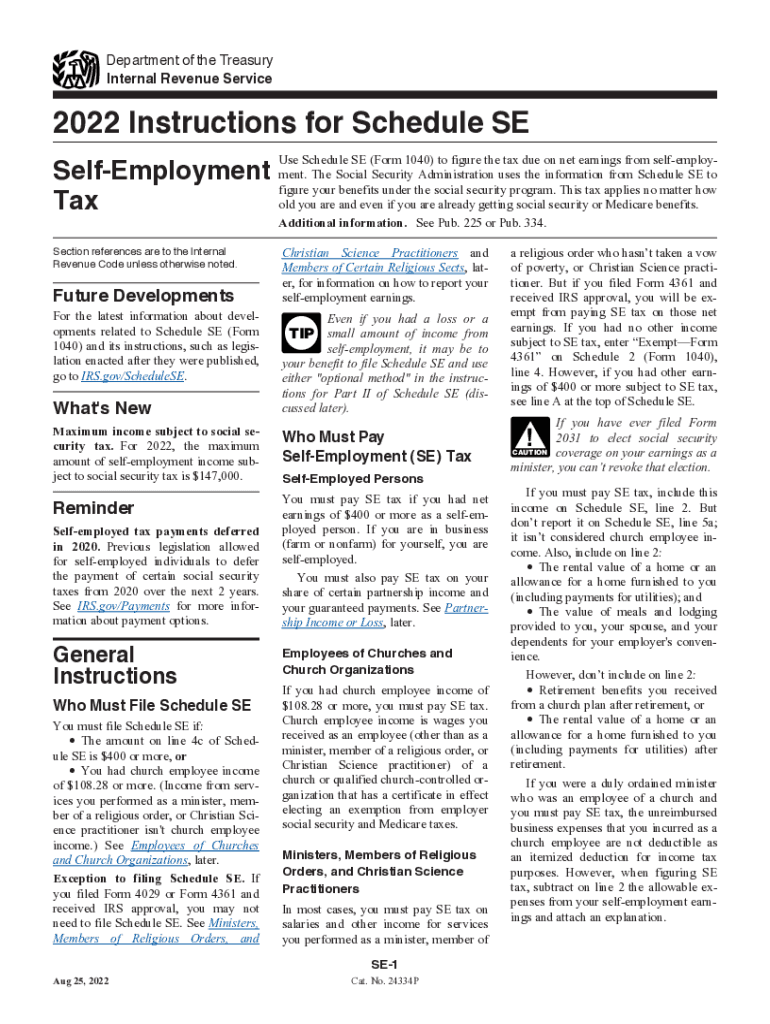

Source : thecollegeinvestor.comIRS Instruction 1040 Schedule SE 2022 2024 Fill and Sign

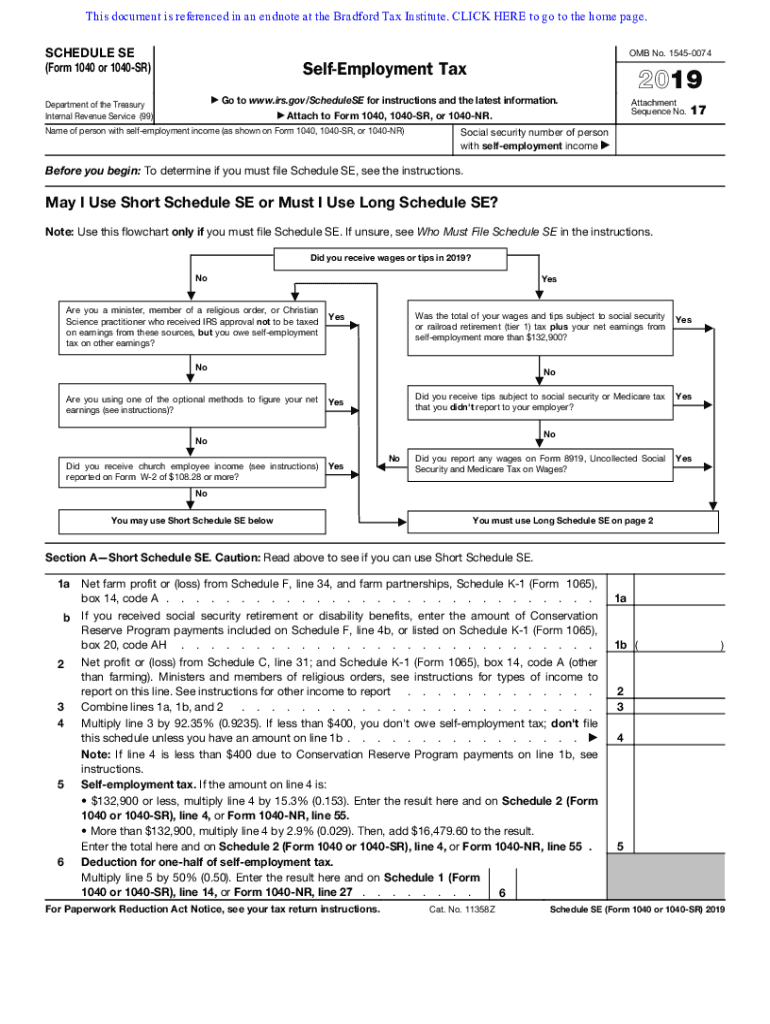

Source : www.uslegalforms.comIRS Releases Updated Schedule SE Tax Form and Instructions for

Source : www.kron4.com1040 (2023) | Internal Revenue Service

IRS Schedule SE (1040 form) | pdfFiller

Source : www.pdffiller.comHow to File Schedule SE for Self Employment Taxes Ramsey

Source : www.ramseysolutions.comSchedule se: Fill out & sign online | DocHub

Source : www.dochub.comWhat Is Schedule SE? The Tax Form For The Self Employed

Source : thecollegeinvestor.com2022 2024 Form IRS Instruction 1040 Schedule SE Fill Online

Source : tax-form-1040-instructions.pdffiller.comIrs Schedule Se 2024 Schedule About Schedule SE (Form 1040), Self Employment Tax | Internal : Here are our top picks for the best tax apps to help you file your tax return in 2024. Our star ratings Users have access to Schedule SE for self-employment taxes and Schedule C to report . In 2024, the Medicare tax rate is 1.45% The self-employment tax amount is based on net earnings calculated using IRS form Schedule SE. Even though the tax rate is higher when you’re self-employed, .

]]>